S&P 500 Stock Map 4.0.0

Continue to app

Free Version

Publisher Description

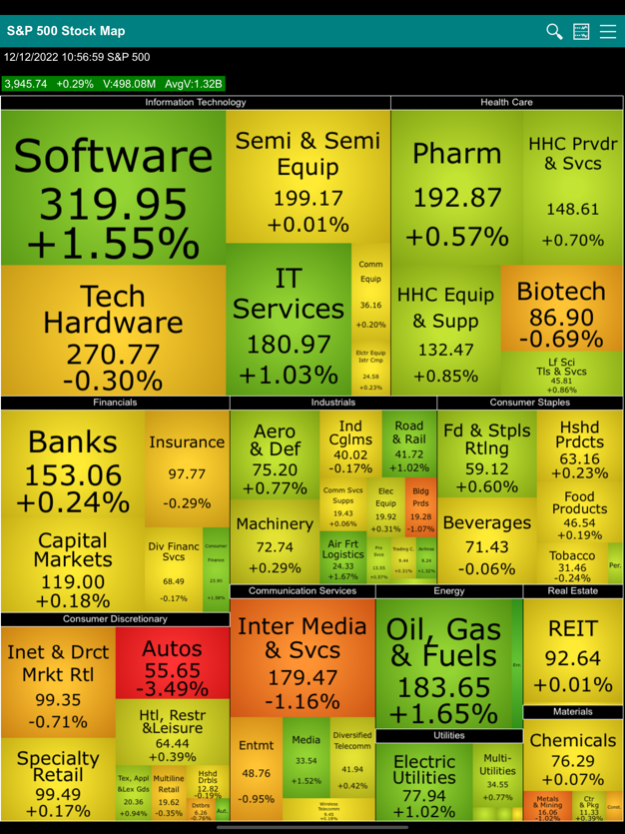

SP500 Stock Heat Map. Real time data. Sector, Industry and Stock map levels. OHLCV, Performance (Gain), Avg Vol, strength, momentum, intraday chart and fundamental data.

.S&P500 Stock Market Heat Map

.Intraday Market Data update every minute when stock market opens

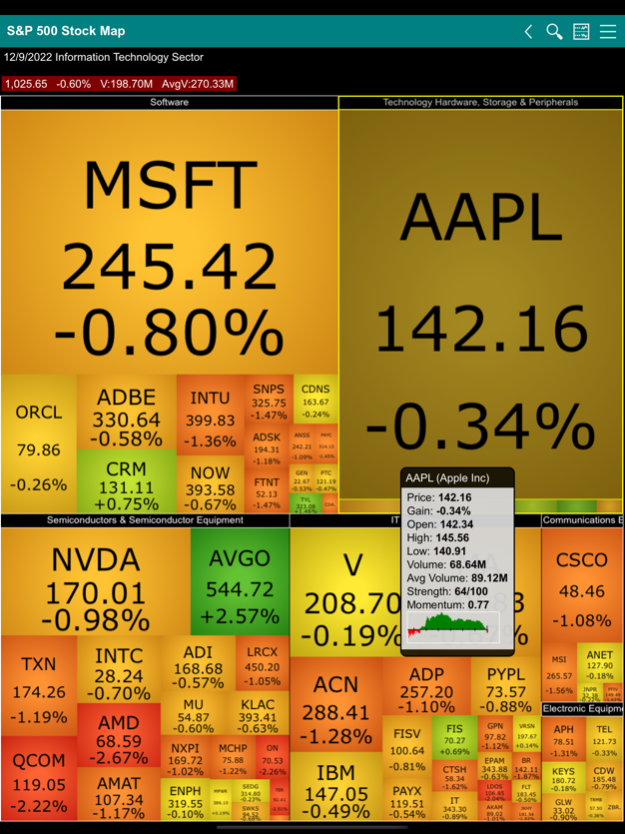

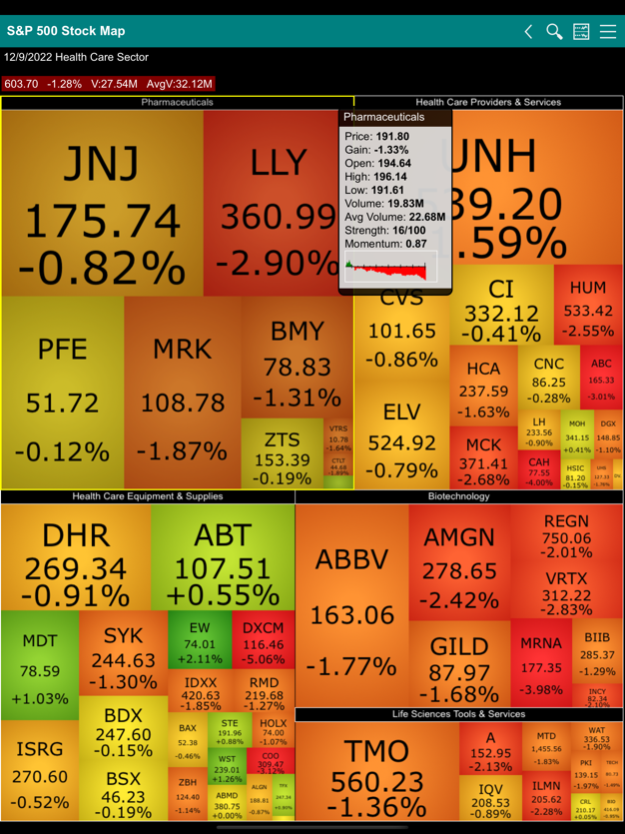

.Three levels of map: Entire index, Sector, and Industry maps

.Performance (Gain), Volume, Average Volume and Index values on Sectors, Industries as well as individual stocks.

."Strength" measures strength of the price movement of a stock compared to others using real time data.

."Momentum" measures trading volume of a stock compared to its own average volume using real time data. Intraday volume strength compares average volume normalized to portion of time elapsed in the session.

.Intraday price chart for all components - stocks, industries, sectors and entire index.

.Colorful representation of gain and loss of indexes and stocks.

.Block sizes represent Market Capitalization of components.

.11 Sectors and 65 Industries.

.S&P 500 compositions and allocations.

.Company fundamental data including market cap, earnings, dividend, short ratio ... and much more.

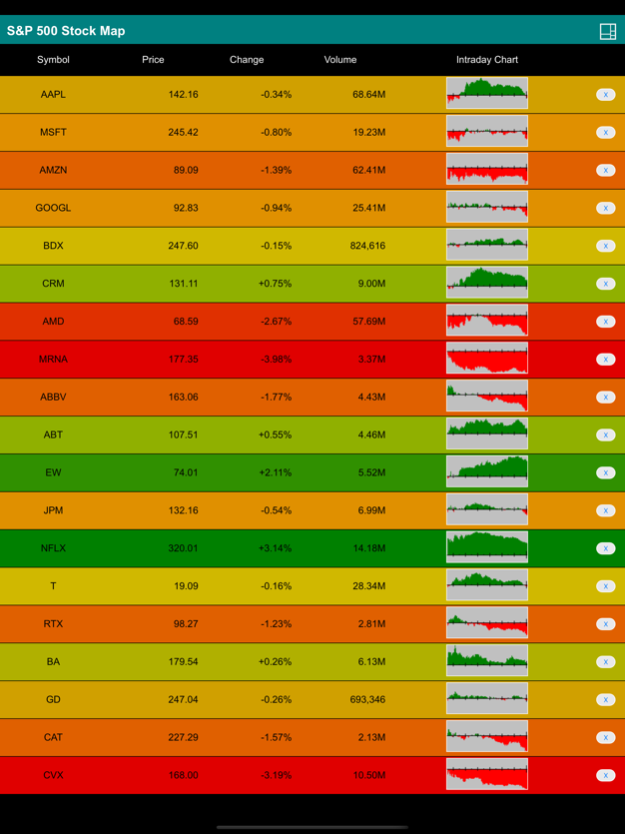

.Watch list displays custom list of stocks.

.Search for stock by symbol and name.

Stock Market Map is a visual representation of stock market data. This specific map categorizes S&P 500 stocks into sectors and industries. The top-level map consists of sectors of the entire market and all the industries under each specific sector. The second-level map starts with a specific sector and consists of all the industries and then all the individual company’s stock under each industry. It is an investment research tool let you quickly view the performance of different sectors, industries and individual companies. The size of the block in the map represents the values of the component (stock or industry) within the portfolio of its parent (industry or sector). The color of the block represents the daily price movement of the component. The overall performance of the entire stock market and/or individual sector can be easily grasped by a glimpse to the map by the color and size of the blocks.

Tapping a block brings up a popup box showing the name, real time price, price gain, volume and the 13 week average volume, relative pricing strength , volume momentum and pricing chart (version 3 new feature) of the sector, industry or individual stock. The name of each component is labeled on top of each block. Double tapping any block from the top-level map navigates to the second-level map of the sector that the block belongs. Tap the back button on the title bar or the back button on the mobile device to navigate back to the top-level map.

The S&P 500 Stock Map tracks stocks using the same compositions and allocations of stocks in the S&P 500 index. The prices, volumes, average volumes and other information of sectors and industries are calculated similarly by BullLabs.com. Indexes are calculated based on the market capitalization of underlying stocks or industries in the level. Sector and Industry specific indexes allow investors to benchmark the performance of investment based on specific stock market sectors or industries. Just as all stocks tend to move based on the underlying factors that drive the overall market, stocks in a similar industry tend to move based on underlying factors that affect the industry. One of the most basic methods for understanding the risk of an investment portfolio is to determine its sector breakdown. Is the portfolio spread across different industrial sectors or is it concentrated in just a few? This provides a good indication of how an investment portfolio will respond to macroeconomic factors or industry trends.

Company fundamental data include Market capitalization, outstanding shares, EBITDA, PEG Ratio, Dividend per share, forward and trailing dividend rate and yield, dividend payout date, ex div date, P/E, trailing and forward PE, price/sales, short ratio, book value, price/book, price target, current and forward EPS, EPS report date, EPS ttm, Basic EPA, Diluted EPS, High/Low EPS estimation, number of analysts.

Dec 12, 2022

Version 4.0.0

.Third-level map shows stocks under one specific industry, allowing small blocks to be visible on small screens.

.Search function finds stocks based on stock symbols or company names.

.Watch list displays custom list of stocks.

About S&P 500 Stock Map

S&P 500 Stock Map is a free app for iOS published in the Accounting & Finance list of apps, part of Business.

The company that develops S&P 500 Stock Map is George Kung. The latest version released by its developer is 4.0.0.

To install S&P 500 Stock Map on your iOS device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2022-12-12 and was downloaded 0 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the S&P 500 Stock Map as malware if the download link is broken.

How to install S&P 500 Stock Map on your iOS device:

- Click on the Continue To App button on our website. This will redirect you to the App Store.

- Once the S&P 500 Stock Map is shown in the iTunes listing of your iOS device, you can start its download and installation. Tap on the GET button to the right of the app to start downloading it.

- If you are not logged-in the iOS appstore app, you'll be prompted for your your Apple ID and/or password.

- After S&P 500 Stock Map is downloaded, you'll see an INSTALL button to the right. Tap on it to start the actual installation of the iOS app.

- Once installation is finished you can tap on the OPEN button to start it. Its icon will also be added to your device home screen.